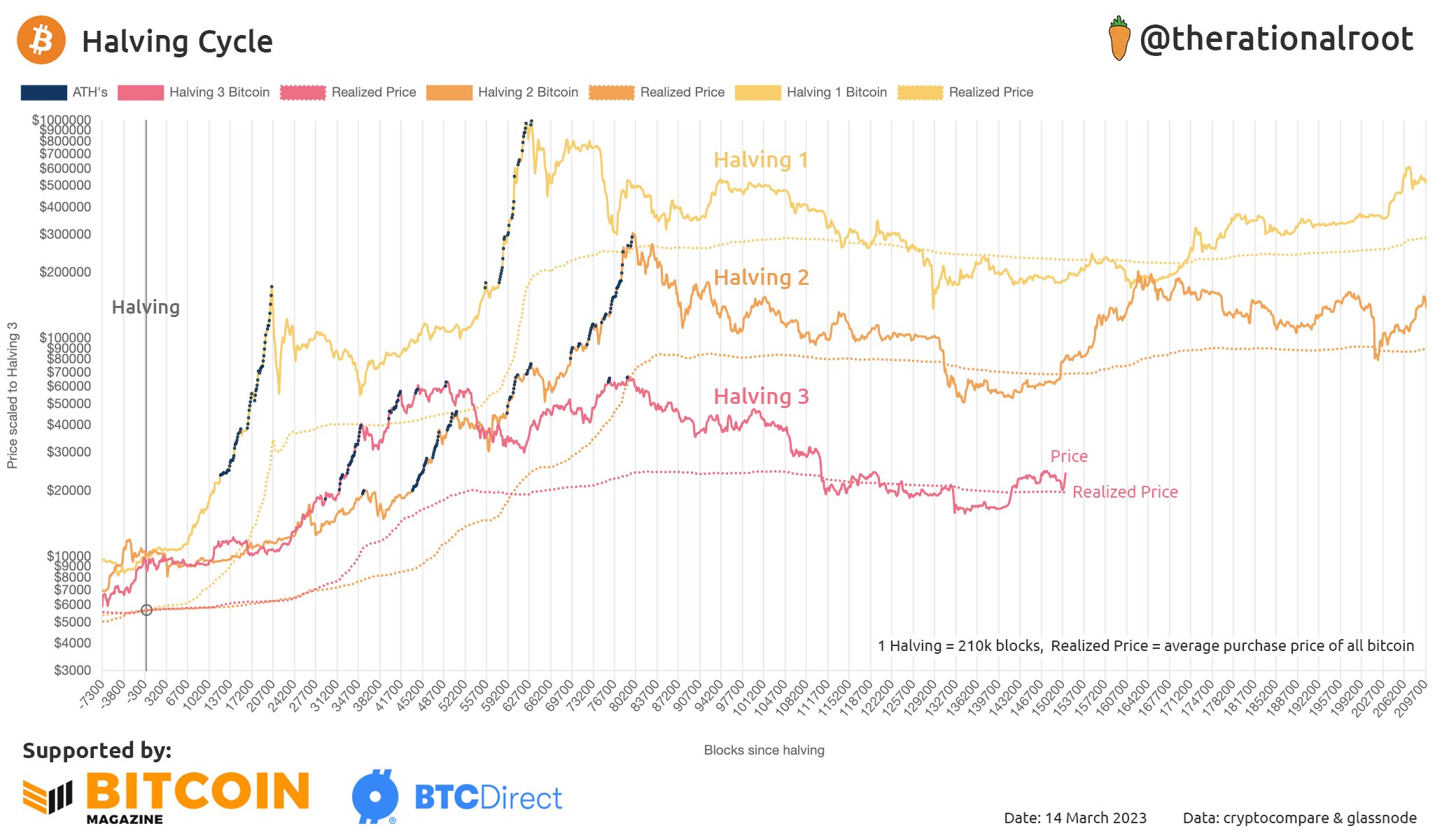

As the present Bitcoin halving cycle proceeds to advancement, right here’s what the previous cycles looked like at similar points in their lifespan.A “halving” is a regular occasion where Bitcoin’s mining benefits (that is, the block awards that miners get for addressing blocks) are cut in fifty percent. This occurs every 210,000 blocks or about every 4 years.As the block benefits are generally the quantity of brand-new BTC supply being developed, being halved ways that the property comes to be much more scarce. This is why the halving is a function of the BTC blockchain; by managing scarcity like this, the inflation of the coin can be checked.So much, Bitcoin has actually observed 3 cutting in half occasions: initially in November 2012, second in July 2016, and also 3rd in May 2020. The following such event is approximated to take location sometime in 2024. Initially, the incentive for mining a block was 50 BTC, yet today, besides these halvings, miners are getting just 6.25 BTC per block.Since halvings are routine, they are a popular means of mapping BTC cycles by utilizing them as the begin and end factors. An analyst on Twitter has done the exact same as well as has actually compared the various cycles so much versus each other making use of the number of blocks given that the cycle begins as the common measure between them.Here is a chart illustrating this contrast:

As you can see in the above graph, the different Bitcoin cycles until now have actually revealed some comparable features.

Especially the previous and also current ones share some strange similarities.The tops of both these cycles appear to have developed after a similar variety of blocks had actually been created in the cycles. The halving 1 cycle saw this happen earlier, however not by too much nevertheless. The bearishness bottoms of all 3 cycles likewise had very closely timed occurrences, with the halving 2 and also 3 cycles once more sharing a tighter timing.Although the timing isn’t as striking as the bases, the most recent cycle structure up a rally out of the bear lows also looks similar to what happened in the second cycle, where the April 2019 rally took place.Something that also appears to have actually held up throughout these cycles is the partnership between the rate of Bitcoin as well as its recognized price. The recognized price is a metric originated from the recognized cap, which is the capitalization design for the cryptocurrency that aims to supply a”reasonable value “for it.In short, what the understood cost indicates is the typical purchase rate or price basis in the market. This indicates that when the price dips under this level, the

average owner participates in the loss territory.During advancing market, this degree has actually served as support in all the cycles, while this behavior has flipped in bearish durations, where the degree has actually offered resistance to the asset instead.From the graph, it shows up that Bitcoin retested this degree extremely recently and efficiently bounced off it, with the rate of the asset getting some sharp upwards momentum.If the pattern held throughout the halving cycles is anything to pass, this can recommend that a favorable transition has actually now occurred in the market and a rally similar to the April 2019 rally might have begun.At the time of creating, Bitcoin is trading about$ 24,600, up 11 %in the recently. For updates and exclusive deals enter your email. Likes to write, passionate regarding cryptocurrency. Currently researching Physics at university. Bitcoin information site giving damaging information, guides, cost evaluation about decentralized digital money & blockchain technology. © 2023

Bitcoinist. All Civil liberties Scheduled.

Thank you for joining us on this exploration of blockchain news.

Until next time, stay curious and keep exploring.